Predicting the Future: Leveraging What-If Scenario Modeling for Life Insurance Organizations

With the unprecedented Covid-19 pandemic sitting in our rear-view mirror and the potential for an economic recession looming ahead, the insurance industry is struggling to plan for uncertainty in the consumer market. A record $90 billion of life insurance policies were paid out in 2020 alone; nearly a 16% increase over the previous year. This unexpected volatility is pushing industry leaders to demand more of their Actuarial and FP&A teams. But what makes this industry different and what can be done to ensure insurance businesses are better prepared for the foreseeable future?

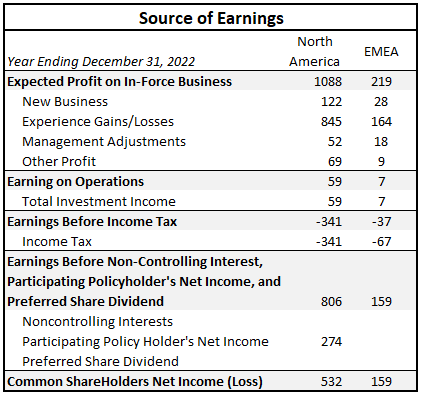

Why is Accounting and Finance different in Life Insurance? For starters, there are significant differences in source data between an insurance and a traditional manufacturing business. Historical and budget data are derived from actuarial models – not a general ledger. The balances of reserves, benefits, and premiums, along with hundreds of other variables are all taken into consideration when deriving base financial data. Profit and Losses are measured across cohorts, a collection of new insurance policies that begin over a defined period, which are tracked over time using a balance-to-date view. In Life Insurance, the management team measures the profitability of these cohorts by reviewing a Source of Earnings (SOE) – a report containing both P&L and Balance Sheet Accounts that track changes to business financials from a product, investment and expense point of view. There are significant differences between the business’s organizational structure as well. The Planning and Budgeting process is a combination of efforts between the actuary team and finance. The actuary teams provide large, complex models to Finance, who then aligns these models to the business’s strategies.

Figure 1 – Sample Source of Earnings (SOE) Statement

What are the obvious gaps? It is common for the Actuary team and Corporate Finance to operate in heavily disjointed workstreams within an insurance company. One team predicts the numbers and the other works with leadership to make the numbers happen. Consequently, the finance team only receives the final figures of an actuarial model and not the assumptions or drivers that went into its creation. This can lead to misunderstanding the data and the creation of financial drivers that are not directly aligned with the model’s direction. Besides working in silos, both the departments and the business as a whole typically deal with extremely large data sets. Forecast data by cohort is derived for the life of the policy. That can result in well over 100 years (1200 periods) of data for a single group of policies. Even the most advanced Enterprise Resource Planning (ERP) solutions will struggle to manage, organize, and move data at this magnitude.

How can Black Diamond Advisory Help? To put it simply, insurance companies have some of the most complex business structures and largest data repositories of any industry. Addressing these challenges require an advisory team with both the industry domain knowledge and the product development experience needed to properly standup a customized enterprise solution. Black Diamond Advisory is a leader in planning and forecasting, and analytics. We would start by completing a full gap analysis based upon the organization’s unique project goals. From a functional standpoint, this would involve:

- Working with executive stakeholders to better understand reporting needs and capabilities

- Identifying communicative details that need to be passed between parties to ensure the consolidated financial statements are properly aligned with the starting actuarial models

- Completing process mapping exercises to identify bottle necks, redundant tasks, and individual process owner responsibility

From a technical standpoint, this would involve:

- Mapping out the technical landscape to identify inefficiencies in middleware and metadata management

- Stress testing key IT components to determine data storage and transfer limitations

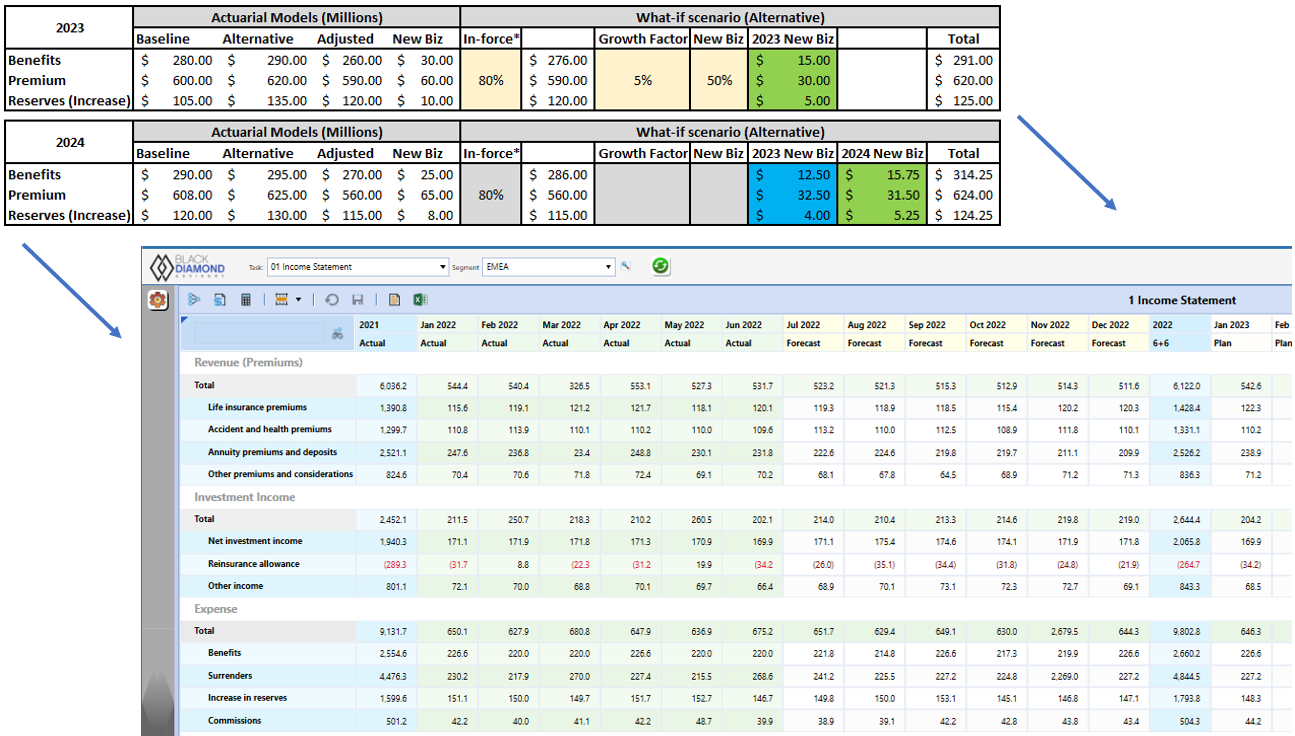

Leveraging a What-if Scenario Analysis and the Accordion Forecast. Outside of traditional advisory service offerings, BDA can explore whether What-If Scenario Modeling is an appropriate fit for your life insurance organization. Our subject matter experts have developed a truly innovative OneStream based solution that interpolates actuarial models into a single forecast. Depending on your businesses needs, we can blend existing in-force data along with new business predictions to come up with an unlimited number of potential scenarios. Once blended the models can be reviewed in greater detail within our proprietary Accordion Forecast. Together, these dynamic dashboarding capabilities provide the Finance team complete flexibility to model and visual their forecast.

Figure 2 – Interpolation example detailed in BDA Accordion Forecast

About Black Diamond Advisory. There is one leader in the finance transformation, analytics, and OneStream partner space that creates value by combining process and business innovation thinking with the power of the platform that allows you to become Best in Class. BDA has established a framework of OneStream solutions to accelerate your planning and forecasting.